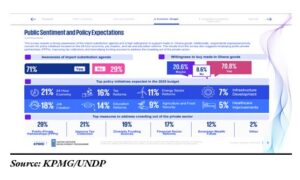

Local businesses have expressed strong confidence in government’s 2025 budget, citing expectations of tax relief and economic expansion.

However, industry leaders warn that without decisive revenue generation and fiscal discipline, the country risks widening its fiscal deficit.

A new survey conducted by KPMG in collaboration with the United Nations Development Programme (UNDP) found that 80 percent of businesses believe government policies in the 2025 budget will drive economic recovery.

The optimism is largely anchored in expectations that the administration of President John Mahama will abolish certain taxes and implement the 24-hour economy initiative, which many see as a catalyst for job creation and business expansion.

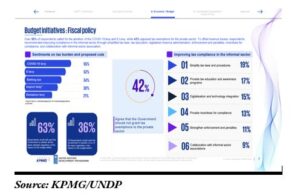

“More than 50 percent of respondents have called for the e-levy and COVID-19 levy to be scrapped,” the report stated, highlighting widespread dissatisfaction with these taxes.

While their removal would provide relief for businesses and consumers, government would forgo an estimated GH¢6.4billion in revenue.

Survey respondents, which cut across large corporations and small businesses, acknowledged the challenge of maintaining fiscal stability while rolling back unpopular taxes. Many suggested alternative revenue measures, including broadening the tax base to incorporate the informal sector, reintroducing road tolls and taxing digital services.

“Rather than simply removing revenue measures, this presents an opportunity to explore alternative solutions such as enhancing tax compliance, leveraging AI-driven tax audits and addressing illicit financial flows,” stated UNDP Ghana’s Resident Representative, Niloy Baerjee.

Expanding property taxation is another key recommendation. The report suggests implementing a tiered property tax, which would be added to household utility bills and based on property value and use “for direct and equitable collection”.

It also proposes accelerating the rollout of digital cadastral mapping to improve documentation of property ownership and valuation, ensuring more efficient tax collection.

The informal sector remains a significant untapped revenue source, with businesses advocating “a flat-rate or tiered tax system for informal sector operators (e.g., traders, artisans), with simplified registration and mobile-friendly filing platforms in multiple languages”.

Additionally, respondents called for a digital services tax targetting freelancers, content creators and gig workers, many of whom operate outside traditional tax structures.

Beyond revenue generation, the survey highlights a need for aggressive expenditure control and waste reduction. Respondents identified several areas where government could curb spending without compromising essential services.

“One of the most immediate ways to address revenue shortfalls is to improve efficiency in government spending and plug revenue leakages,” the report stated, pointing to procurement inefficiencies, salary fraud and loss-making state-owned enterprises (SOEs) as major concerns.

To address procurement waste, respondents recommended “mandating the publication of all awarded contracts, including pricing, scope and selection criteria – via the e-Procurement system – for public scrutiny.”

The survey also callex for a comprehensive audit of the public payroll system to remove ghost-workers and streamline payroll processes.

In the public sector, businesses support freezing recruitment and limiting wage increases – with 30 percent calling for a ban on luxury vehicle imports for government use. The report suggests privatising or divesting underperforming SOEs to reduce their drain on state resources.

The survey also reflects broad support for government’s proposed 24-hour economy initiative, with 72 percent of respondents believing it will create jobs and drive economic expansion. However, businesses emphasise that its success depends on critical infrastructure improvements.

“For Ghana’s 24-hour economy to work, the right infrastructure, policies and incentives must be in place,” the report noted.

The top priorities include enhancing security and public safety, ensuring reliable electricity supply and improving transportation networks.

Businesses also suggest targetted tax breaks and grants for sectors naturally suited to round-the-clock operations, including healthcare, digital services, logistics and retail.

“This year’s report arrives at a moment of renewed hope… The 2025 budget stands as a canvas to paint this shared ambition, blending innovative policies with practical measures to deliver on government’s mandate,” added KPMG’s Country Managing Partner, Andy Akoto.