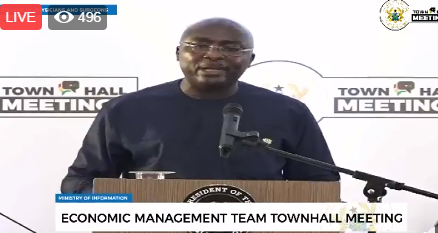

Vice President and head of the Economic Management Team Dr Mahamudu Bawumia on Wednesday, April 3 addressed Ghanaians on the state of the economy.

Dr Bawumia touched on some key sectors of the economy and how they have performed over the past two years when they took over the administration of Ghana.

Full speech below:

Good morning. It is a pleasure to have the opportunity to share with you some progress on the state of our economy after two years in government during which we have been implementing the policies that Ghanaians voted for.

This occasion also provides the Economic Management Team (EMT) an opportunity to interact with the public and to answer questions on the economy. The timing of this interaction is also important because it was only yesterday (April 2nd) that Ghana formally and successfully completed the IMF programme that we inherited when we assumed office in 2017.

On behalf of members of the EMT, I present to you our progress, where we are and the way forward. Our presentation today as always is based on an analysis of the data and facts. The data will speak for itself. If you disagree, then you should bring your own data and record but don’t disagree by saying that EMT members have big heads. You only resort to insults when you are allergic to the facts.

First, let me recall briefly the state of the economy we inherited and how far we have come since 2016.

Public Finances Prior to 2017

At the heart of Ghana’s recurrent economic difficulties has been the management of public finances, especially during election years and the challenges in cleaning up the post-election fiscal mess. Our public financial management and our fiscal excesses, particularly in the run-up to the 2012 elections were very damaging to our prospects of managing an economy that is trying to climb up the middle-income ladder.

The economy ended in 2012 with a fiscal deficit of 12.2% of GDP, 11.7% in 2013, 11.9% in 2014 before falling to 6.7% in 2015 but rose again to 9.3% in 2016. We recorded for the first time in Ghana’s history double digit fiscal deficits in three consecutive years and plunged into a deep fiscal hole. Debt pile up began, debt service became burdensome on the budget, inflation soared, external trade balances worsened and the economy became more and more vulnerable to external shocks.

7. This poor state of public finances, weak policy implementation and lack of policy credibility resulted in Ghana requesting an IMF bailout in August 2014.

8. Since there was no meat on the bone, to fill the deep hole in public finances, government resorted to some tough fiscal measures; notably the increase in the tax burden on every conceivable consumption item and production activities.

9. In addition to hiring freezes, there were cuts to a number of areas of spending, most notably were cuts to research allowances for lecturers, nursing training, and teacher training allowances.

10. By the end of 2016, the fundamentals of the economy were generally weak:

o Real GDP growth (Our ability to produce goods and services in the economy) declined from 9.1% in 2008 to 3.4% in 2016.

o Growth in agriculture was declining

o Industry growth was in the negative

o Rising public debt had pushed debt-to-GDP beyond the 70% threshold for comparable economies to 73.1%. As a result, Ghana was classified as a country at high risk of debt distress, a classification that we are still trying to change.

o Interest rates were high

o The banking system was weak

o With rising unemployment, unemployed graduates association became the new unenviable club in town.

When you look at the data on the overall performance of the previous government on the macroeconomic indicators, you will notice a distinctly different performance between the 2009-2011 period and the 2012-2016 period. The 2012-2016 period was much worse even though the external environment was favourable.

OVERARCHING OBJECTIVES

11. So what have we done in the past 2 years? Following the overwhelming mandate to change the trajectory and fortunes of the economy, the President, Nana Akufo-Addo set down his markers for change.

12. The overarching objective is to build a modern, prosperous and a private sector driven economy anchored to the vision of Ghana Beyond Aid.

13. This overarching objective will be broken down into a number of sub-objectives. These are:

o pursuit of a stable macroeconomy to give the economy needed handles of certainty for better planning by households, businesses and government as well.

o pursuing Inclusive Transformation to help the poor and vulnerable in our society and ensure social equity.

o pursuing the formalization of the economy by leveraging on technology and digitization

o enhancing the Ease of doing business to remove bottlenecks that impeded private sector development

o Reforming and enhancing the competitiveness of our ports as major national asset

o Transforming the structure of the economy through diversification, technological innovation, and greater value addition in our production processes.

All these are to be supported by building a sound banking system, strengthened infrastructural investment, and good governance, especially in fighting corruption. Let me share with you our progress on these fronts.

RESTORING MACROECONOMIC STABILITY

14. A major flagship programme of government is the restoration and sustainability of macroeconomic stability as the anchor for economic growth and enhanced private sector investment.

The Pillars

GDP growth and per capita income

15. The ability of the economy to produce goods and services measured by real GDP growth is increasing. Growth for 2017 was 8.1%, significantly exceeding the average sub-Saharan African (SSA) growth of 2.7 percent (Figure 1). GDP growth remained robust in 2018, almost double the average growth in SSA.

Non-oil growth has increased from 4.6% in 2016 to 5.8% in 2018 (Figure 2)

16. The strong growth performance of the economy translated into a steady rise in the share of every Ghanaian in national output, which today at GHC9,864 is 30% higher than in 2016 (Figure 3). Our challenge is to make the distribution fair, especially to the benefit of the weak, disadvantaged and vulnerable in society. This is the ultimate goal of our inclusive transformation.

Sectoral growth performance

17. The recent growth performance has been driven mainly by industry and agriculture sectors, the latter particularly reflecting the effect of policy interventions in the sector, most notably the planting for food and jobs. This has resulted in an increase in agric sector growth from 2.9% in 2016 to 6.8% by 2018 (Figure 4). The agric sector growth has been driven by crop production.

Figure 4: GDP growth driven largely industry and agriculture sectors (%)

18. The industrial sector performance has been underpinned by petro carbon production initially, and increasing investment in the manufacturing sector as we work to stabilize the macro environment and improve the ease of doing business (Figure 6).

FISCAL AND MONETARY POLICY

19. The growing confidence in the macroeconomy owes a lot to the prudent management of our public finances and monetary affairs over the last two years. The Ministry of Finance has focused on aligning government revenue with expenditure in order to reduce the fiscal deficit. The Bank of Ghana has performed its complementary role in managing our monetary and financial environment.

20. The efficiency in expenditure management has come from the prioritizing and re-allocation of spending to areas most needed. Fiscal deficit (on cash basis) has significantly fallen from 6.8% of rebased GDP in 2016 to an estimated 3.8% in 2018 (Figures 7 and 8).

21. For the first time in a decade, Ghana recorded primary balance surpluses (that is our tax revenues exceeded all government spending—excluding debt service payments) for two years in a row. The primary balance surplus was 0.5% of GDP in 2017, 1.4% in 2018, compared to a primary deficit of 1.1% of GDP in 2016. A positive primary balance means a slowing down in the rate of debt accumulation.

To underpin fiscal discipline going forward, Ghana has for the first time in our history passed into law a Fiscal Responsibility Act that limits the fiscal deficit in any year to a maximum of 5% of GDP and requires a positive primary balance. In addition, a Fiscal Council has been established to provide oversight and advice on the implementation of fiscal policy.

Public Debt

22. Total public debt has increased from GHC122 billion in 2016 to GHC173 billion (including the cost of the banking sector clean-up) at the end of 2018. However, the strong fiscal adjustment and better debt management has meant that rate of debt accumulation (at 12% in 2018 excluding the banking sector clean-up) is the lowest in the last decade.

23. Although in absolute terms interest payments have increased over the last two years, with much better debt management, interest payments as a percentage of GDP declined from 6.9% of GDP in 2016 to 5.6% of GDP in 2018, reducing the burden of the debt on the budget.

24. Total public debt as percent of GDP slowed to 54.8 percent in 2018, creating room for government to accommodate the painful but very necessary banking sector reforms which cost government close to 3.2% of GDP

Inflation and interest rates

25. A combination of prudent monetary policy and fiscal consolidation in the last 24 months, supported by zero central bank financing of government and strong external sector developments have underpinned a steady disinflation process over the past 24 months. Inflation has dropped steadily from the high of 15.4 percent at the end of 2016 to 9 percent at the end of January 2019, the lowest we have seen in the last six years (Figure 11).

26. The steady disinflation process provided scope for significant monetary policy easing. The Bank’s Monetary Policy Rate (MPR) has been cut by a cumulative 950bps between 2017 and January 2019 (Figure 12). This has translated into a reduction in short term interest rates. Lending rates have also fallen from an average of 32 percent in 2016 to 27 percent in 2018 (Figure 13).

Soundness of the Banking Sector

27. Further to strengthening the monetary and financial environment, the Bank of Ghana has recently undertaken key reforms in the banking sector aimed at strengthening the sector to support the growth agenda of government. The consolidation of banks from 34 to 23 and the liquidation of 9 of them at the end of December 2018 have resulted in a banking sector that is well-capitalized, liquid, and well-positioned to improve the flow of funds in the economy and to drive private-sector-led growth and development.

28. This has not been costless. Government had to spend a total of some GH¢12 billion for the banking sector clean-up in order to restore confidence and promote financial stability. In all we have managed to save some 1.5 million depositors from losing their deposits, some their entire life-time savings. The clean-up has also resulted in fresh capital injection in excess of GH¢4.0 billion into the banking industry.

According to the Bank of Ghana, “private sector credit growth has gained some momentum stemming from improved liquidity position of the banks on the back of the recapitalization exercise. Annual growth in private sector credit was 21.1% in February 2019, compared with 2.4% growth in the same period of 2018. In real terms, private sector credit expanded by 10.9%â€.

29. Going forward, Government and all financial regulators are committed to promoting a strong and resilient financial system. The establishment of the Financial Stability Council is to ensure effective coordination among the financial regulators to strengthen financial stability.

External Sector Performance:

30. Ghana’s external payments position has strengthened. For the first time in over two decades, the trade balance (the difference between what we export and what we import) recorded a surplus in 2017, and even larger surplus in 2018. It is not because we importing less, but largely because of increased exports of oil and exports of other traditional commodities (cocoa and gold). The positive trade balance has resulted in a significant narrowing of the current account deficit as a percent of GDP (figures 14 - 17).

31. Improvements in current account performance and increased capital inflows have helped to boost international reserves over the last 24 months. Gross international reserves reached US$7.56 billion at the end of December 2017 (4.3 months of import cover). Despite these improvements, net foreign exchange reserves declined in 2018 for two reasons. First, is the forex sales by the Bank of Ghana in its normal exchange rate management. Second is the portfolio outflows as foreign investors repatriated coupons and principal investments because of rising US interest rates and concerns over Ghana’s exit from the IMF programme. Following the recent Eurobond issue, Ghana’s Gross international reserves as at end March 2019 stands at $9.9 billion, equivalent to 5 months of import cover.

Exchange rate developments

32. The exchange rate is simply the price of one currency relative to other currencies, for example the Cedi to the US$. At the basic level, it is influenced by the relative demand and supply for the foreign currency. Factors such as the inflation rate, the balance of trade, fiscal balance, money supply (the fundamentals) influence the exchange rate. But speculation and expectations about these fundamentals, external shocks such as oil price increases, can also have powerful short term impacts on the exchange rate.

33. When we see pressures on exchange rate, first we need to determine where these pressures are coming from, and second whether the pressures are transitory or are likely to be permanent. And as every astute central banker knows, even with strong economic fundamentals, speculation, expectations and investor sentiments can exert pressures on the exchange rate.

34. Ladies and Gentlemen, you will recall that I stated in 2014 that if the fundamentals are weak, the exchange rate will expose you. That was true then and will always be true. It is 100% correct. But it is warped logic to jump from that to a conclusion that if there is a depreciation of your exchange rate then the fundamentals must be weak. That defies logic. There could be other external factors causing the exchange rate depreciation. For example, if I tell you that if your leg is broken you will be unable to walk, it does not mean that if someone comes to tell me that you are unable to walk I can conclude that your leg must be broken. There can be other reasons why you are unable to walk. But the NDC logic will insist in the face of contrary evidence that since you cannot walk then it must mean that your leg is broken.

35. In 2014, the exchange rate depreciated by 31.3%. The fiscal deficit was 10.1%, Public Debt to GDP rose to 70.2%, Inflation rose to 17%, and GDP growth declined from 7.3% to 4.0%. In other words the economic fundamentals had weakened significantly and therefore the depreciation was easily explainable. It was not caused by dwarfs or high rise buildings as we were being told. The exchange rate had exposed the weak economic fundamentals. The Table below shows the fundamentals in 2014 and 2018.

36. So how has the cedi performed recently? At the end of December 2017, the cedi cumulatively depreciated by 4.9 percent (9.6 percent in 2016) against the US dollar — the cedi’s best performance since 2011.

37. The cedi depreciated by 8.4% in 2018 largely on account of emerging market pressures and US interest rate increases. The data on annual rate of depreciation of the cedi in recent years shows that the worst performance from 2017-2018 is better than the best performance between 2012 and 2016 (Figure 16).

38. The start of 2019 has been characterized by another sudden bout of sharp depreciation of the cedi which has since largely been reversed. Within a week the cedi reached GHC5.9/$ in the market but sharply appreciated to GHC 5.07/$, an unprecedented development and without any intervention from the Bank of Ghana. As at 29th March, the year-to-date depreciation of the Cedi for the first quarter of 2019 stood at 5.18%.

39. The most important reason and the proximate cause of the recent depreciation is the time inconsistency of an IMF prior action on reserves target. At the end of January, As part of the 7 prior actions to complete the IMF program which went to the Board on March 20, 2019, the Bank of Ghana was required to ensure net international reserves (NIR) target on March 14, 2019, are the same levels as it was at the end of December 2018]. To meet the IMF program prior action, the Bank of Ghana had to rather build up (increase) reserves in a period of extreme demand pressures by some $800 million, and had no room to intervene in the foreign exchange market in line with approved intervention policy. This partly explains why the Ghana cedi came under significant pressure during this period which was exacerbated by speculation.

40. Contrary to some speculation, the Bank of Ghana did not spend any reserves to revive the cedi following the initial depreciation. Some people have misunderstood the requirement by the IMF for the Bank of Ghana to build up its reserves by some $800 million to mean that the Bank of Ghana used that money to reverse the depreciation of the cedi. The reason for the sudden reversal in the sharp depreciation that we observed was that the market corrected itself. Investor sentiments, expectations and uncertainties acknowledged that the fundamentals are much stronger than suspected, and that even without the IMF, fiscal and monetary discipline are assured. The reversal of the depreciation that has taken place supports the fact that the fundamentals are indeed strong.

41. We should recall that the weak fundamentals in 2014 meant that the NDC government of the day had to end up seeking a bailout from the IMF! The difference today is stark and glaring. Because our fundamentals are strong Ghana only yesterday (April 2nd, 2019) formally exited the IMF program which the NDC government got Ghana into in 2014 because of weak fundamentals.

42. Indeed, the strength of Ghana’s fundamentals was confirmed on March 16, 2019 by Standard and Poor’s (S&P) Global which affirmed Ghana’s sovereign rating as B with a stable outlook after upgrading Ghana’s sovereign credit rating from B- to B with a stable outlook last year. This was the first upgrade by S&P for Ghana in 10 years!

43. Second, Ghana also successfully issued a $3 billion on the Eurobond at more favourable rates than previous issues. The amount offered by investors of $20 billion is a record in Africa and a strong affirmation of the positive assessment by the international financial markets of Ghana’s economic fundamentals.

BEYOND MACROECONOMIC STABILITY

44. Distinguished Guests, Ladies and Gentlemen. Macroeconomic Stability is very important. It is like fresh air that you can easily take for granted until the air is fouled. However, macroeconomic stability alone is not sufficient. It must translate into the well-being of Ghanaians in their everyday living: safe drinking water, good roads, jobs, access to good healthcare, stable and affordable electricity, and good education among others.

45. Here are some of the major policies the government of Nana Addo Dankwa Akufo-Addo is implementing that go to the core of the aspirations of Ghanaians:

INCLUSIVE TRANSFORMATION

46. The inclusive transformation agenda is to empower Ghanaians regardless of their circumstances and reducing hardships. We are doing so on 3 fronts:

• First, building human development capacity and expand job creation opportunities

• Second, enhancing access to public services

• Third, empowering local communities, and invest in local infrastructure development

Where are we on these fronts?

47. Human Development Capacity and Expanding Job Creation Opportunities

• Free SHS is a major transformation initiative to developing the human capacity of the future

• The 36% increase in enrollment in 2018 alone means and additional 181,000 students who would otherwise have been denied secondary education now have a chance to build their future

• Reserving 30% of places in elite schools for people from deprived areas is a little step in addressing inequality of opportunities

• A $1.5 billion GETFUND financing has been arranged for educational infrastructure, especially in 400 school blocks and dormitories.

• We have doubled the Capitation Grant (From GH¢4.5 to GH¢10) and expanded school feeding to cover additional 500,000 children.

• The Nation Builders Corps (NABCO) of 100,000 graduates is a step in building the job skills of our graduates to be absorbed into the workforce.

• The available data shows that recruitment and financial clearances for the security services, Education, Health, Forestry, YEA, and NABCO, over the last two years amount to over 350,000 jobs. This is just for these specific sectors.

• Because of the expansion of the economy and better payroll management, the wages and salaries as a percentage of GDP has declined from 7.2% of GDP in 2016 to 5.8% of GDP in 2018. With the economy growing, the private sector is also adding jobs.

• We have restored nursing training allowances

• We have restored teacher training allowances

• We have abolished fees for post graduate medical training in Ghana

48. Enhancing access to and delivery of public services

• Medical delivery by drones to get delivery of critical medicines and blood to hospitals and clinics in hard to reach areas will be starting in three weeks.

• We have increased the share of the DACF to persons with disabilities from 2% to 3%.

• We have also ensured the implementation of our pledge of employing 50% of the persons who manage the country’s toll booths from amongst Persons with Disabilities.

• The LEAP empowerment has added 150,000 beneficiaries.

27. Expanded School Feeding from 1.6 million children to 2.1 million children, and also increased the amount spent on each child by 25 percent.

• On pensions, in November 2017, Government transferred some GH¢3.1 billion of Tier 2 pension funds into the custodial accounts of the pension schemes of the labour unions, funds that had been outstanding since 2013, and about which the labour unions had been loudly complaining. This payment paved way for the implementation of the public sector occupational pension schemes.

49. Empowering Local Communities and Building Local Infrastructure

• We are empowering individuals and local communities. For the first time, Government in 2018 provided support to the Creative Arts Council, and the Creative Arts Masterclass, to build the capacity of Creative Arts practitioners. For example, the Eastern Regional Theatre has been completed, and work is currently ongoing towards the construction of the Kumasi theatre.

• Under the National Entrepreneurship and Innovation Programme, 1,350 start-ups and small businesses have benefitted from a special government business support programme with beneficiaries receiving between GH¢10,000 and GH¢100,000 each, at a special interest rate of 10%.

• Increased access to electricity and a reduction in tariffs of 17.5% for households and 30% for businesses have been beneficial.

• We have established the Zongo Development Fund to finance infrastructure in our Zongo communities.

IPEP

Through the Infrastructure for Poverty Eradication Programme (IPEP) initiative, various projects are at different stages of completion across the 275 constituencies, including the:

• construction of 1,000 Ten-Seater Water Closet Institutional Toilets with Mechanized Boreholes, and bio digesters, which are disability friendly.

• construction of 1,000 Community-based water systems with 10000 liters reservoir tank and a number of distribution points, with a capacity to serve over 2400 people per day.

• construction of 80 thousand-metric ton warehouses in collaboration with the Ministry of Agric. These warehouses are equipped with dryers, laboratories and solar powered under the “One District One Warehouse Initiative.â€

• construction of dams in the five northern regions, in fulfillment of the “One Village One Dam promise.

• construction of 50 rural markets in some selected constituencies.

• construction of 26 clinics to support healthcare delivery in some deprived communities.

• provision of other infrastructure, including drainage systems, foot bridges, renovation of schools, community town centres, reshaping of roads, among others, as part of the assessed needs of constituencies.

• procurement of 275 well equipped ambulances for each of the 275 constituencies

• supply of 10,000 hospital beds to some selected hospitals in the country

On the management of the economy, many may not appreciate how much work has been done by this government. But if you ask the question:

“ How do you take an economy in a deep fiscal hole, with no meat on the bone, with a high deficit and debt burden and high interest rates; an economy which could not pay basic obligations such as teacher and nursing training allowances with a with a weak banking system on the verge of collapse etc. reduce or abolish 17 taxes, implement free SHS, restore teacher and nursing training allowances, NABCO, introduce so many social interventions etc, and at the same time significantly reduce the deficit, and increase economic growth?.

It takes competent economic management to do that.

LEVERAGING ON TECHNOLOGY AND DIGITIZATION FOR FORMALIZATION OF THE ECONOMY

50. Ladies and Gentlemen, Ghanaian society and micro and small businesses continue to be largely informal. In such an environment, access to services, targeting in the delivery of public services to those who need these services most (the elderly, the vulnerable, the deprived, and even pensioners) become difficult, and in most cases depends on who you know. For the banking sector, lending rates are high partly because of the high information problems in establishing identity, and in verifying ownership of property. These have to change if we are aspiring to become a modern middle income country.

51. It is for all these reasons that we are aggressively pursuing the agenda to formalize the Ghanaian economy through digitization. For the public sector, leveraging on technology and digitization of systems improve administrative systems and the way we govern ourselves.

52. In a well-functioning society, citizens don’t need to know someone or pay someone to get a passport, driving license and even access to water and electricity. We cannot build a fair and equitable society that runs on engines of bribes, “goro boys†and “land guardsâ€.

53. With digitization, we are introducing new and more efficient ways of doing things. We are changing the way things are done in the affected institutions for the benefit of ordinary Ghanaians. Here are a few of the reforms we have undertaken in the digitization and formalization process in the last two years.

i. The introduction of National ID Cards is a game changer despite its teething challenges. So far about 500,000 cards have been issued, covering public sector institutions and the two pilot constituencies of Adentan and Madina. The mass issuance should resume at the end of April.

ii. On Digital Property Addressing, the process of tagging all 4 million houses with digital addresses are on-going

iii. Digital Drivers licenses and vehicle registration have been working.

iv. Mobile money payments interoperability has been implemented. This is a major step to financial inclusion and movement towards cashless payments for government services.

v. The digitization of land registry is in progress.

vi. Passport applications are now online, and passport duration has increased from 5 to10 years

vii. Renewal of NHIS registration via mobile phone has been a phenomenal innovation with an average of 70,000 renewals every week. Simply dial star 929 hash (*929#) on any mobile phone network.

viii. To enhance access to telephone and digital services in rural areas government has deployed 200 rural telephony sites for broadband access serving 500 communities in the last two years compared to 78 sites in 8 years by the previous government.

ix. Finally, the management of State transport has introduced online ticketing for State Transport Corporation buses where you can book and pay for your ticket using the mobile phone. This is currently being piloted.

54. We have launched an emergency 112 number for the police, fire and ambulance services and work is ongoing to integrate the emergency 112 number with the National Digital Address System so that the emergency services will immediately identify the exact location of incoming calls.

55. The digitization of Police information systems has resulted in the deployment of 1000 cameras across the country with a central monitoring centre in Accra as well as digitized call centres in Kumasi and Tamale. Together, the Accra, Kumasi and Tamale centres monitor all the 16 regions. In the next phase of the programme, an additional 8000 cameras will be deployed throughout the country to help fight crime, and protect property.

REDUCTION IN THE COST OF DOING BUSINESS

56. As part of the digitization agenda, we have also automated many processes to ease the cost and hassle of doing business. For example:

• To register a business, instead of filling four separate forms to start a business, only one form is now required. The Registrar General has merged all four starting-a-business application forms: TIN application, SSNIT application, Business Operating Permit application and Business Registration forms.

• The automation of the application for Business Operating Permit along with instant online issuance following payment

• Automation of the construction permit system. A major relief to local contractors.

• Even more remarkable is the implementation of an electronic justice system that allows the automated serving of court process with speed and ease. When fully operational, court documents will be easy to find and track, and there will be no duplication of the same case by heard in different court rooms by different judges.

• Getting Electricity to your house has been reduced to 3 steps and should become paperless by end of this year.

• The introduction of Paperless Port system has reduced the time to clear goods at the ports to less than 48 hours.

• Reduced or abolished 17 nuisance taxes

CHANGING THE STRUCTURE OF THE ECONOMY THROUGH VALUE ADDITION

57. Virtually every government has noted the need for Ghana to change the structure of the economy through diversification and by shifting from the focus on the production of raw materials to value addition. This is a key pillar of Nana Akufo-Addo’s Ghana Beyond Aid agenda. To accomplish this, Government is implementing the following programmes:

• Planting for Food and Jobs to increase agricultural output for agro processing and food sufficiency. The results have been remarkable. Increased in productivity and harvest in 2018 has led to exports of food crops such as cassava, rice, yellow and white maize, soya, plantain, cowpea and yam to Burkina Faso, Togo and Cote d’Ivoire.

• The establishment of the Ghana Commodity Exchange (GCX), an ultra-modern trading system linked to warehouses located across the country, is to connect markets, and expand marketing and farm gate opportunities for buyers and sellers of agricultural produce.

• The “One-District-One-Factory†policy has taken off, and 79 factories under the scheme are at various stages of operation or construction. Another 35 are going through credit appraisal.

• Already established businesses are also receiving help, with an amount of GH¢230 million to be disbursed among sixteen (16) companies under the stimulus package.

• The process of starting an Integrated Bauxite and Aluminum Industry is a major step in diversification and innovative in financing.

o Ghana Integrated Bauxite and Aluminum Development Corporation law has been passed.

o Ghana Integrated Aluminum Development Corporation Established

o The process to select the joint venture partners to undertake the aluminum refinery project is underway.

o And the latest good news is that we have begun a partnership conversation with Guinea, the world largest producer of bauxite, on how to collaborate in an integrated supply chain from bauxite to alumina and to refined aluminum using our revived VALCO.

• The facilitation of the growth of an Automotive Industry is on course

o A National Automotive policy, including incentives for the industry has been approved by cabinet

o Kantanka automobiles will benefit from the incentives

o Volkswagen, Nissan, Suzuki/Toyota, Sino Truck will have all signed MOUs to establish assembly plants in Ghana.

• The Ghana Integrated Iron and Steel Industry bill is before parliament and is expected to be passed into law hopefully before parliament rises. It is similar to the Integrated Aluminum industry law and will result in the establishment of the Ghana Iron and Steel Development Corporation to spearhead the process.

58. Changing the structure of our economy through diversification and value addition will not happen overnight. And it remains a major pre-occupation of the government because it is our pathway to reduce dependency, expand the economy, create jobs, increase exports, reduce imports and support the value of our currency.

Energy Sector

59. The energy sector is key for industrialization. We inherited many challenges in the sector but they are being addressed. Ghana has excess capacity in energy generation but the contracts entered into for many of these IPPs are expensive and financially burdensome. Most of these contracts are “take or pay†arrangements. This means that even if we don’t need the power, we still have to pay for it. Ghana is currently paying $24 million a month in excess capacity charges alone for power we have not used. This will increase to about $41 million a month later this year, with the coming onstream of CEN Power, Early Power and Amandi power plants.

• Even though we don’t have problems with power generation capacity, we have some problems with transmission. The GRIDCO network is old and it has been unable to invest in high capacity lines because of financial difficulties.

• The takeover of ECG by PDS is expected to resolve the needed investments in our distribution sector. The Millennium Challenge Corporation (MCC) compact with the United States Government which called for a concessioning of ECG has been successfully completed and this will result in an injection of over $1 billion in investment in the power sector from the private concessionaire and MCC over the next five years. Ghana has also been selected for consideration for a third MCC compact with a regional focus.

• Ghana has enough gas to power all our plants without relying on imported gas. Gas is also much cheaper than liquid fuel. This is why a policy decision has been taken to switch largely to the use of gas in energy generation. However, while most of our gas is in the West of Ghana, most of our power plants are in the East. The Ministry of Energy is therefore taking steps to remove the gas transportation bottlenecks, to ensure that Ghanaian gas can reach power plants located in the eastern part of the country. This will ensure that Ghana uses locally produced gas for the bulk of its thermal power generation, saving substantial amounts of foreign exchange on imported fuels. Ghana will save at least $300 million annually by switching from liquid fuel to gas according to World Bank estimates.

• The West Africa Gas Pipeline supplies gas from East to West. The reverse flow project is to move the gas from West to East and construction began in September 2017.

 Temporary By-Pass (Phase 1) has should be operational this month and will allow gas flow of 60mmscf.

 Reverse flow phase 2 – an additional 55mmscf – should be completed between July and August. Once this is done, Ghana will not need imported gas in the foreseeable future.

 Move of the Karpower plant to the West by August 2019 will increase the gas offtake in the West and balance the grid.

• At the heart of the problems of the energy sector are the short collections by ECG (PDS). This leads to non-payments to service providers in the value chain (GRIDCO and IPPs).

 Since government is a major culprit as most MDAs don’t pay their bills, it has been decided Ministry of finance will now pay MDA electricity bills directly to PDS on behalf of the MDAs

 Use of pre-paid smart meters is to be increased significantly by PDS to increase collections.

 An interim distribution mechanism ( a cash waterfall mechanism) of the proceeds of collections by PDS has now been agreed with suppliers in the value chain.

FIGHTING CORRUPTION

60. Ladies and Gentlemen, as a government, we remain committed to making corruption unattractive on a sustainable basis. This calls for collaboration and strengthening of institutions mandated by the Constitution and other laws of the country to protect the public purse.

The Government has over the past two years increased financial and human resources available to the Auditor-General for the discharge of his constitutional mandate. The total budget for “Goods and Services†which is also the money used in financing audit activities carried out by the Ghana Audit Service stood at GHC14million in 2016 but only GHC9million was released to the Service. In 2017, the current Administration released GH19million to the Audit Service for goods and services; in 2018, a total of GHC33million was released and the budget for 2019 is GHC35million. Similar increases in allocations and releases have been done for CHRAJ.

Timeliness of Reporting

In the past, we used to see the reports of the Auditor-General two, three or more years after the end of the financial years to which they related but since our Government came into office, the reports of the Auditor-General for the year ended 2016 were all submitted to Parliament between July and October 2017 and for the first time in the history of our country, four reports of the Auditor-General for the financial year ended 31st December 2017 were released on 15th June 2018.

On 23rd January 2018, the Auditor-General submitted a report to Parliament covering the audit of liabilities of Ministries, Departments and Agencies (MDAs) as at 31 December 2016. In that report, out of the total claims or liabilities amounting to GH¢11.810 billion submitted by MDAs through the Ministry of Finance to the Audit Service, an amount of GH¢5.479 billion was disallowed by the Auditor-General.

In addition to this, 112 Certificates have been issued and a total amount of GH¢511,211,239.04 was levied against individuals, companies and institutions who committed financial infractions against the State. Also, GHC67million had been recovered from disallowances and surcharges. This is protecting the public purse.

The Economic and Organised Crime Office (EOCO) has also recovered GHC51 million of taxes owed to the state by some private companies, institutions and individuals within the last 18 months.

The appointment of a Special Prosecutor, independent of the Executive, is an obvious indication we want to protect the public purse and to make corruption unattractive in Ghana. Government has allocated GH¢180 million to the Special Prosecutor to fight corruption and we will provide additional resources as needed to enable the Office execute its mandate.

The Right to Information (RTI) Bill which has been on the radar for the last 20 years has finally been passed into law. This is historic and a major legacy in the fight against corruption. The rationale for the bill is to give right and access to official information held by public institutions, private entities which perform public functions with public funds. This new Act, when operational, will be a game changer in the fight against corruption.

The Attorney General is also prosecuting a number of people for alleged corruption. Some of the notable prosecutions currently underway include:

o THE REPUBLIC V. STEPHEN OPUNI AND 2 OTHERS (COCOBOD)



o THE REPUBLIC V. EUGENE BAFFOE BONNIE AND 4 OTHERS (NCA)

o THE REPUBLIC V. ERNEST THOMPSON AND 4 OTHERS (SSNIT)

o THE REPUBLIC V. SEDINA TAMAKLOE & DANIEL AXIM (MASLOC CASE):

The Public procurement Authority has implemented e-procurement as well as resorted less to sole-sourcing. Between April 2017 and December 2018, an amount of GHC1.9 billion was saved due to the discovery of procurement malpractices.

PORT REFORMS

61. Our ports remain important national assets. And we must manage it to improve trade to the benefit of all Ghanaians. Government has devoted considerable energy over the past 2 years engaging with different stakeholders – shippers, importers, exporters, freight forwarders, traders, spare part dealers listening to their concerns. What was baffling to us was that even though the NPP government had not increased import duties, there were persistent complaints that duties at the ports were high.

62. Government set up a Ports Review Committee to review the competitiveness of Ghana’s ports within the West Africa Region. Here are some surprising findings.

• Except for Nigeria ports, the total marine charges and security fees charged at Tema for container handling far exceed those of our key competitors—3 times the charges in Lome, nearly twice the charges in Abidjan.

• No port in West Africa is charging the equivalent Ghana Maritime Security fee of nearly $20,000.

• Import handling charges are higher in Tema than any port in West Africa.

• While nearly 90% of containers that come to Tema are physically examined, only 5% are physically examined in most modern ports. Physical examination is a major source of corruption at the ports. Data shows that physical examination contributes less than 0.4% of additional revenue to the State. The time, unofficial facilitation fees and the energy spent in collecting this amount totally negates any gains this may have brought to government.

• Many port charges are a percentage of the value of the goods and this makes them exorbitant and hardly justifiable. Why should the cost of scanning a container, vehicle examination fee, and network charge be a percentage of the value of the goods in the container? Why should the cost of processing the documentation covering imports be a percentage of the value of the imports when most modern ports are charging flat fees?

• The benchmark values applied by Customs to various commodities in the computation of import duties in Tema are much higher than in Lome, Abidjan and Dakar. In many cases, more than 100%-200% higher.

63. For example, the assessed value for a used Ford Focus (2009) is US$9017.2 in Tema, but US$3139.3 in Lome and Abidjan. With this assessment, the total clearing cost for this vehicle is US$4423.7 in Tema, US$2386 in Abidjan and US$2103 in Lome.

64. We have an archaic practice. When many importers are unable to pay their duties, their cars and commodities are confiscated, and auctioned off very cheaply at prices often much less than the duty owed.

65. For importers, the choice of ports is clear. There is an increasing diversion of trade away from Tema port and smuggling of many items into Ghana is very tempting. Container import volumes into Lome port between 2013 and 2018 increased by over 300% (or 60% annually) while Ghana container import volumes into Tema increased only by 4.1% annually over the same period.

66. New Measures

Cabinet has made the following decisions with the objective of ultimately increasing trade facilitation, efficiency and revenue from the port. Ghana is losing huge amounts of container traffic and for that matter revenue to Lome and other ports:

a) To reduce the incidence of smuggling and enhance revenue, the benchmark or delivery values of imports have been reduced by 50 percent except for vehicles which will be reduced by 30% effective 4th April 2019. This means for example, if a container was previously assessed for duty at a value of $20,000, it will now be assessed from tomorrow at a value of $10,000. We expect that the higher volumes of at least 50% annually and increase custom revenues

b) Also, the physical examination of containers is to be reduced from over 90% to under 10% by June 2019. Customs and any other government operatives at the ports should adhere to the recommendations of the risk engine under the paperless regime. The risk engine allows for the incorporation of specific intelligence on containers. Where containers are selected by the risk engine for examination, there will be joint examination which must include National Security.

c) There should no longer be separate examinations of containers by any government operative at the gates of exit.

d) Government will also begin the implementation of the First Port Rule in June 2019 so that duty on all transit items will be paid at our port to the Customs representatives of the country of destination. We will implement a strict “no duty no exit†policy for containers without exception. This will block leakages and increase revenue.

e) Going forward, Ghana will adopt a flat fee structure for port and customs charges for any new single window operator in line with best practices of charges at major ports globally.

Subject to Parliamentary approval, Government will also review the following measures on port charges to enhance the efficiency of port operations.

f) The service charge of $1.50 per ton of every export and $2.0 per ton of every import levied by Ghana Shippers Authority.

g) The importer registration fees imposed by Ghana Standards Authority.

h) the recently introduced Eazy Pass levy of up to 0.5% of the CIF value of goods by Ghana Standards Authority.

i) the security charge of $0.50 per gross tonnage of every vessel coming into Ghana’s waters charged by Ghana Maritime Authority (GMA).

j) the $7 per new tyre eco levy charged by EPA, and the eco levy of 0.5% CIF value charged by EPA on a number of import items.

67. To deal with the lack of information on the status of a consignment and the duty payment, a mobile app has been developed to enable importers check the status of their consignment and the import duty payable online. The app can be obtained on google playstore and will also soon be available on iTunes. It is called Ghana Trade Hub mobile app. An importer just needs to have an Import Declaration Form number to access the information.

These reforms are expected to increase revenues as container volumes through the port increase. However, in the short term, necessary fiscal adjustments will be made to accommodate any temporary revenue shortfall to maintain fiscal discipline.

Ladies and gentlemen, this is just two years of hard work. The achievements our government have been remarkable given the situation we inherited.

68. When you manage any economy, you are bound to face challenges and surprises from time to time but it is how you deal with the challenges that matter. What we need to do is to develop the capacity of the economy to respond to the ups and downs of the market forces through strong fiscal and monetary management and coordination. Ghanaians can be assured that this is what the fiscal and monetary managers are doing so well.

The establishment of the Fiscal Stability Council and the Financial Stability Council are powerful signals of the government determination to prevent any unpleasant surprises in the way we manage the economy going forward.

We will be the first to admit it has not all been rosy and that there is still a lot more to do; and the full impact of some of our initiatives are not immediate but will be very significant to the country in the very near future.

Our hospitals still need a lot of work and attention to enhance the quality of medical care, our education system will continue to need improvement, we still have challenges in the energy sector and so on. We are dealing with many problems that we have had as a country for over 60 years but I am sure that any neutral observer will agree that we have after only two yours in office (given the situation we inherited), made a solid start.

The Future is Bright

69. Looking to the future, one can say that Ghana’s future under the leadership of President Nana Addo Dankwa Akufo-Addo is bright and the prospects of growth are promising.

We are implementing a plan to change the structure of the economy.

• Two years into the Planting for Food and Jobs and now for Exports, we have learnt a lot and we are optimistic.

• Under the One District and One Factory and the stimulus package for businesses, industry growth is on the uptake. Gradual improvements in the Ease of Doing Business and the National Entrepreneurship and Innovation Programme are stimulating business start-ups.

• The emerging automobile industry, the integrated bauxite and aluminium industry to be followed by iron and steel, petro-chemical and value addition processing are our pillars of diversification to change the structure of the economy. And we must train our young labour force to match these changes in the economy.

• The pace of digitization that is currently underway will make Ghana one of the most digitized economies in Africa in the next five years.

• That is not all, Ghana’s recent oil discoveries could significantly boost production starting in 2021. If the envisaged developments progress without delays, they could potentially double oil production in 2021, to roughly 400,000 barrels-per-day.

70. The new Aker discovery contains at least 500 million barrels and that will raise economic growth to 10% and above from 2021. There are potentially other discoveries likely by Exxon, and other big players currently exploring. The apparent discovery of oil onshore in the Voltain basin will add to Ghana’s potential economic boom. If we manage these resources properly and don’t take risks with people who have demonstrated an inability to manage our economy, Ghana will be a very positively different country in a few years’ time. This will help change the structure of production, move Ghana away from the Guggisberg economy, and further boost Ghana’s economic prospects.

Some Forthcoming Infrastructure Projects

71. The government’s integrated infrastructure development and investment programme is on course across the country. This covers investments in a modern road network, water systems, aviation, ports, harbours and railways. Some of the forthcoming projects include:

• Sinohydro Master Project Support Agreement

• 12 Fish landing sites

• Pwalugu multi-purpose dam

• Bui solar hybrid and irrigation project

• Between Pwalugu and Bui, 60,000 hectares to be brought under irrigation compared to 12,980 hectares of government financed irrigation since GIDA was set up in 1977

• Railways

o The Accra to Tema railway service has started running on the refurbished line.

o Rehabilitation of Accra/Nsawam line is almost complete.

o Work is continuing on the rehabilitation of the Kojokrom to Tarkwa

o Work on the standard gauge section from Kojokrom to Manso is ongoing.

o Eastern Line, Western and Tema-Ouagadougou lines are being tendered.

• Housing ( 100,000 affordable housing units with United Nations Office of Project Services)

• $1.5 billion GETFUND school infrastructure projects

• Volta Lake Transport( Mpakandan to Mankango)

• Tamale Airport Phase 2

• Kumasi Market Phase 2

• Construction of Four (4) Dedicated Container Terminals

• Multi-Purpose Container Terminal at Takoradi Port

• Dry Bulk Jetty at Takoradi Port

• Construction of Ferry Landing Sites( Dambai, Yeji, Makango and Agordeke)

• 10 Youth and Sports Resource Centers of Excellence underway

CONCLUSION

72. Ladies and Gentlemen, in conclusion, let me reiterate that:

o When it comes to GDP growth, we have performed better than what we inherited

o Agricultural growth - we have performed better

o Industry - we have performed better

o Inflation – we have performed better

o Interest rates – we have performed better

o Exchange rate depreciation- we have performed better

o Fiscal Deficit - we have performed better

o Trade Balance - we have performed better

o Current Account Balance- we have performed better

o Gross International Reserves - we have performed better

o Jobs - we have performed better

o Teacher Training Allowances - we have performed better

o Nursing Training Allowances- we have performed better

o Passport Application - we have performed better

o Drivers License - we have performed better

o Renewal of NHIS membership - we have performed better

o Registering a business - we have performed better

o Cost of electricity - we have performed better

o Taxes - we have performed better

o Efficiency of clearing goods at the ports - we have performed better

o Cost of clearing goods at the ports – we have performed better

o Fighting Corruption - we have performed better

o Right to Information Act- we have performed better

o Zongo Community needs - we have performed better

o National ID Cards- we have performed better

o Mobile Payment Interoperability - we have performed better

o Digital Address System - we are on course

o One district one factory – we are on course

o One Village One dam – we are on course

o One constituency one ambulance – we are on course

o Free SHS – we have delivered

In short, we are managing the economy better and fulfilling our promises. But as I mentioned earlier, we still have more to do.

Thank you for your attention.

May God Bless you and

May God Bless our Homeland Ghana.