The Finance Ministry of Ghana has announced that it will settle outstanding debts on coupons by April 28, 2023.

The decision was made after an engagement with the leadership of the Coalition of Individual Bondholders Groups on the timelines of payment of outstanding domestic debt obligations.

The move comes after the Coalition of Individual Bondholders Groups, which includes the Ghana Individual Bondholders Forum (IBF) and the Individual Bond Holders Association of Ghana (IBHAG), petitioned President Akufo-Addo on April 11, 2023, regarding the non-payment of old bonds that were not part of the recent domestic debt exchange programme.

In a statement, the Coalition expressed regret that the Finance Ministry had consistently defaulted in paying the bonds after they matured.

They also noted that the continuous delay or disregard for the payments was creating undue distress for fellow Ghanaians, particularly pensioners whose sustenance, health, dignity of independence, and honour of responsibility in taking care of their young wards and families are contingent on these savings.

R ead the full statement below;

ead the full statement below;

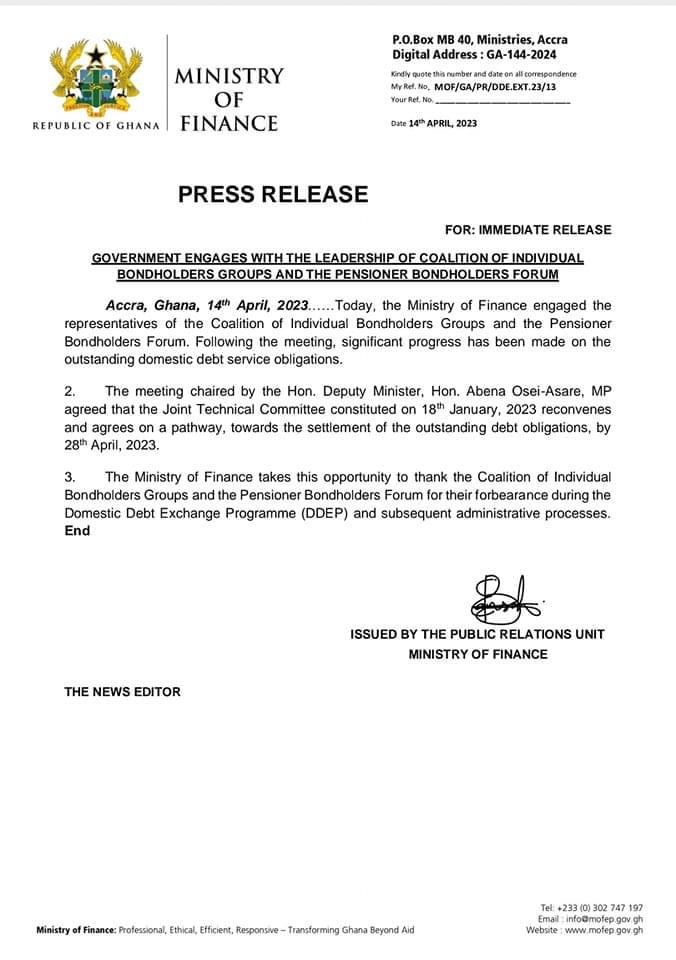

“Today, the Ministry of Finance engaged the representatives of the Coalition of Individual Bondholders Groups and the Pensioner Bondholders Forum. Following the meeting, significant progress has been made on the outstanding domestic debt service obligations.

- The meeting chaired by the Hon. Deputy Minister, Hon. Abena Osei-Asare, MP agreed that the Joint Technical Committee constituted on 18th January, 2023 reconvenes and agrees on a pathway, towards the settlement of the outstanding debt obligations, by 28th April, 2023.

3. The Ministry of Finance takes this opportunity to thank the Coalition of Individual Bondholders Groups and the Pensioner Bondholders Forum for their forbearance during the Domestic Debt Exchange Programme (DDEP) and subsequent administrative processes.”