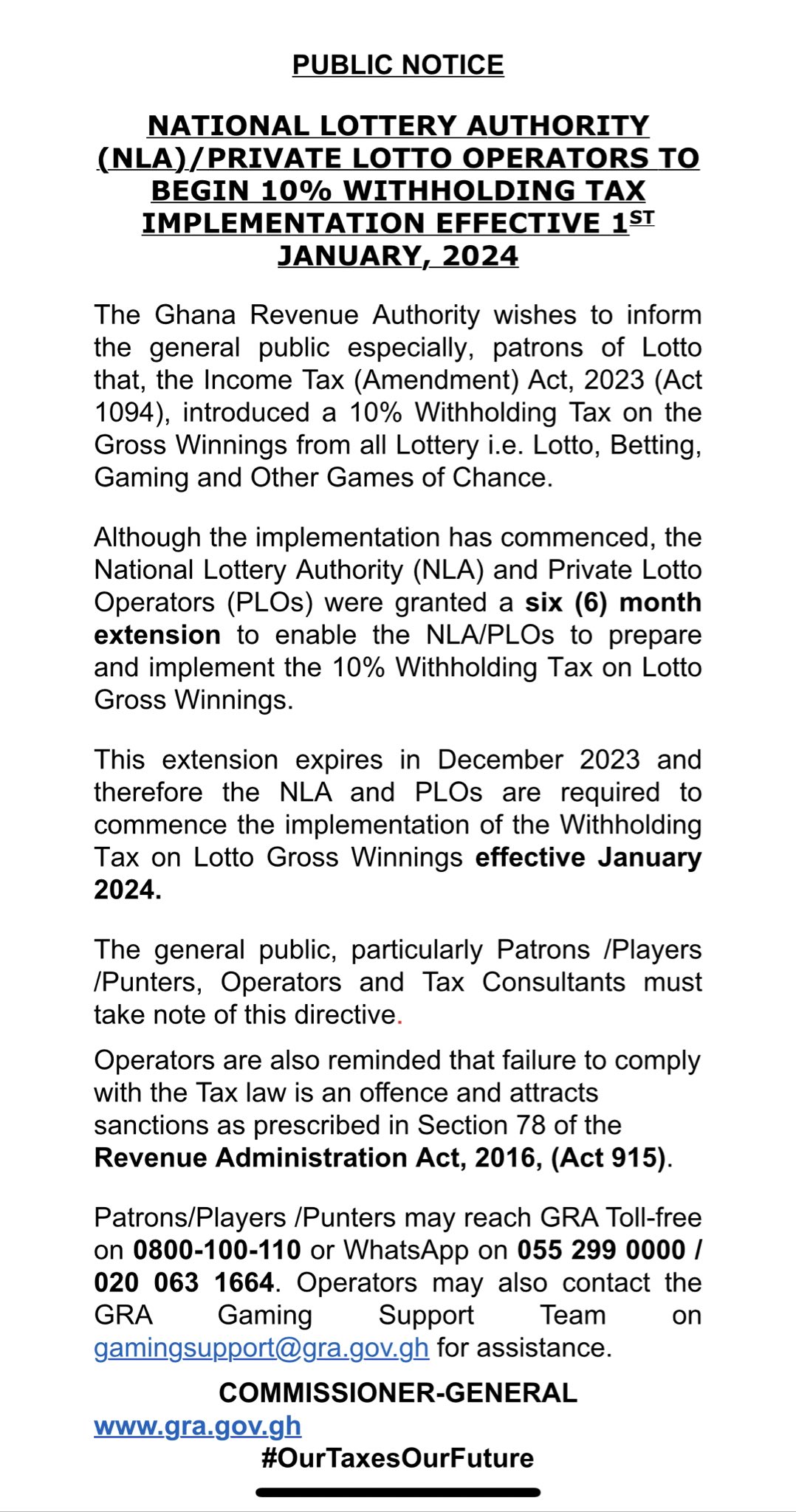

The Ghana Revenue Authority (GRA) has informed the general public, particularly lotto patrons and operators, about the commencement of the implementation of a 10% withholding tax on the gross winnings from all lotteries, including lotto, betting, gaming, and other games of chance.

The Income Tax (Amendment) Act, 2023 (Act 1094) introduced this Withholding Tax, which has been in effect since its implementation.

However, the National Lottery Authority (NLA) and Private Lotto Operators (PLOS) were granted a six-month extension to prepare and implement the tax. This extension is set to expire at the end of December 2023.

Therefore, the GRA has mandated the NLA and PLOs to commence the implementation of the 10% Withholding Tax on Lotto Gross Winnings from January 1, 2024.

The GRA emphasized that compliance with the tax law is mandatory, and failure to do so is considered an offence under Section 78 of the Revenue Administration Act, 2016 (Act 915). Sanctions will be applied to operators who do not adhere to the stipulated tax regulations.

Patrons, players, punters, operators, and tax consultants are urged to take note of this directive.