President John Mahama has assured Ghanaians that his administration will uphold fiscal responsibility and avoid exerting political pressure on the Bank of Ghana (BoG) to print money for government spending.

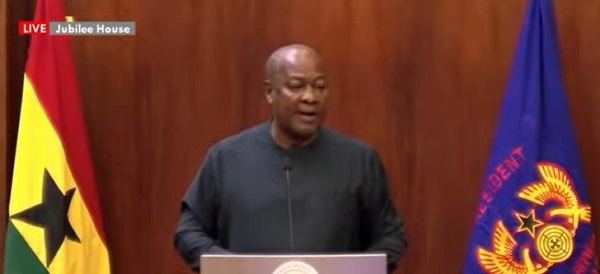

Speaking at the swearing-in ceremony for the newly appointed Governor of the Bank of Ghana, Dr. Johnson Asiama, and his First Deputy, Dr. Zakari Mumuni, at the Jubilee House on Tuesday, Mahama emphasized the dangers of reckless monetary policies, pledging not to repeat mistakes of the past.

"The lessons of the past remind us of the dangers of fiscal recklessness and the lasting harm it can inflict on an economy," Mahama stated. "When government resorts to unsustainable consumption, expenditure financed by excessive and unregulated printing of money, the consequences can be severe—from spiralling inflation and income erosion to driving millions into poverty."

He further underscored the importance of preserving the BoG’s independence, stating, "To safeguard our economy from these risks, we must uphold responsible fiscal management, strict adherence to legal and regulatory frameworks, and protect the independence of the Bank of Ghana. As President, I am committed to ensuring that the Central Bank operates free from political interference, guided solely by its mandate."

In a pointed remark that appeared to reference the previous administration under former President Nana Akufo-Addo, Mahama added, "One thing for sure… I am not going to ask you to print more money."

This comment echoes earlier controversies surrounding the BoG’s 2022 annual report, which revealed that the central bank had printed GH¢35 billion in 2021 and GH¢42 billion in 2022 to finance government expenditure.

The Minority Caucus in Parliament criticized these actions, claiming they breached Section 30 of the BoG (Amendment) Act, 2016 (ACT 918).

Meanwhile, newly sworn-in Governor Dr. Johnson Asiama reaffirmed his dedication to revitalizing public confidence in the financial sector through responsible governance, innovation, and transparency.

Outlining his vision, Dr. Asiama said, "We will create an economic and financial system that is transparent, predictable, and stable. Businesses will have the confidence to plan, and individuals will have access to a secure financial system that fosters growth and opportunity."

He also stressed the importance of restoring trust in the sector, describing the Bank’s new direction as a tangible commitment to rebuilding confidence. "This ‘reset path’ goes beyond words—it represents real actions aimed at strengthening public trust," he said.

Pledging to serve with integrity and impartiality, Dr. Asiama affirmed, "As I take this oath of office, I do so with a solemn promise to the people of Ghana—to serve with diligence, impartiality, and unwavering commitment to the mandate of the Bank of Ghana."

His appointment follows the departure of outgoing Governor Dr. Ernest Addison, who is set to retire on March 31, 2025, after officially proceeding on leave.

Dr. Asiama brings significant experience to the role, having previously served as the Second Deputy Governor of the Bank of Ghana from 2016 to 2017.