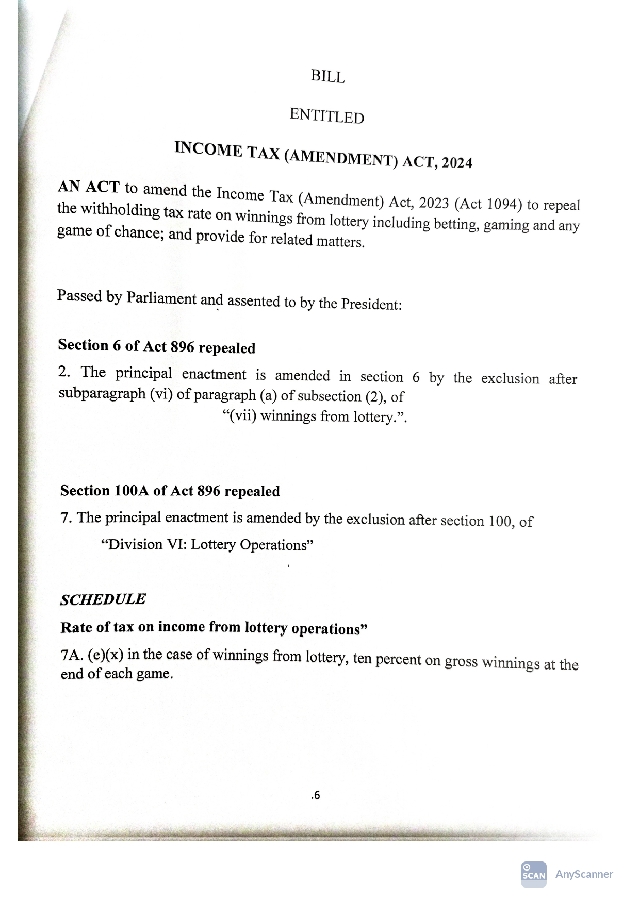

Five Members of Parliament (MP) of the National Democratic Congress (NDC) have introduced a private members bill to repel the betting tax.

They are: Madina MP Francis-Xavier Kojo Sosu ESQ, Ajumako Bisease MP Cassiel Ato Baah Forson, Bolgatanga Central MP Isaac Adongo, Ayensuano MP Teddy Safori Addi, and Tamale North MP Alhassan Sayibu Suhyini.

In a letter to the Clerk of Parliament, the MPs highlighted the current economic challenges and stressed the need for policies that ease financial burdens on citizens. They cited the impact of the Domestic Debt Exchange Programme (DDEP) along with the ongoing issues of unemployment and economic hardship.

They argued that there is an urgent need for tax relief measures to help alleviate the cost of living for Ghanaians, promote savings and investments, and foster sustainable economic growth.

“Furthermore, despite imposition of the tax, a recent Afrobarometer survey published by the Centre for Democratic Development (CDD) reveal that unemployment (41%) is the most frequently cited problem that Ghanaians want the government to address. Again, 7 in 10 Ghanaians revealed that they or someone in their household went without a cash income at least once during the previous year, with 81 per cent of Ghanaians rating government’s economic performance as overwhelmingly negative,” they said.

“Thus, in view of the above, and considering the impact on the Domestic Debt Exchange Programme (DDEP), and the related exacerbation of the twin challenges of unemployment and economic hardships, as well as the seeming lack of adequate safety measures to cushion vulnerable Ghanaians against daily pressing needs; there is, therefore, an urgent need to introduce programmes, including tax policies and measures that seek to rescue Ghanaians in light of the harsh economic realities, reduce the cost of living, promote savings and investments, and achieve economic stability, and sustainable growth, hence this bill,” they concluded.

The 10% withholding tax on gaming winnings was introduced by the Ghana Revenue Authority (GRA) on August 15, 2023, and applies to all gross gaming winnings.