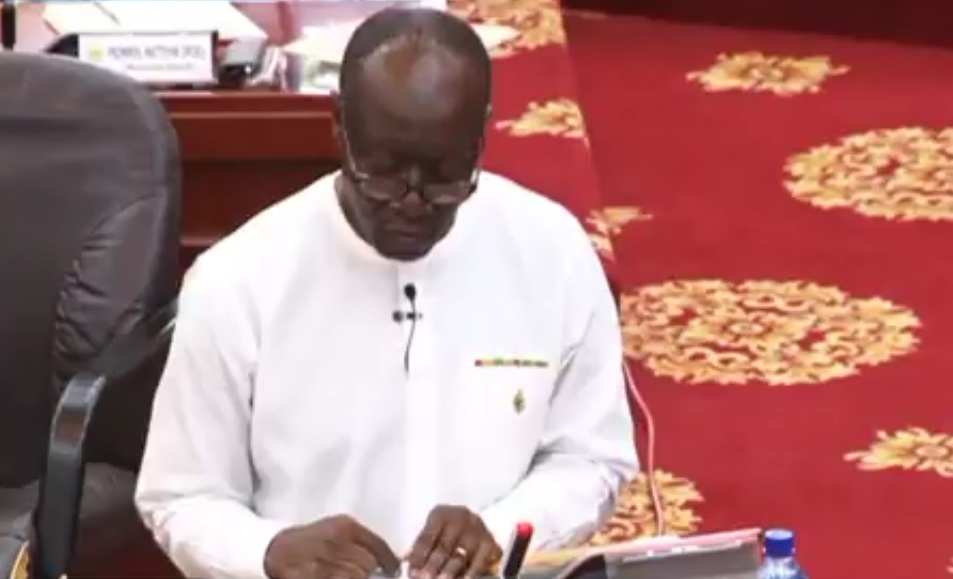

The finance minister, Ken Ofori Atta, today delivered the highly anticipated 2017 budget to Parliament.

In his address, the minister unveiled the plans of the Akufo-Addo to transform the economy for the better and create jobs for Ghanaians.

He said the government planned to block revenue leakages and tackle corruption as part of efforts to raise the revenue required to finance programmes.

Ofori Atta spoke of a long term plan to broaden the tax base as part of the revenue generation effort.

"Revenue administration remains a challenge so we will strengthen tax administration and broaden the tax base but in the long term, we will shift the focus of economic management from taxation to production.

"The economic challenges we face requires deliberate steps and the backing of Ghanaians [but] Ghana is ready because the people are ready [and] in [the] NPP, Ghanaians have a government that is ready to work," he said.

The minister also announced plans to boost the economy by reducing taxes and freeing money for companies to expand and create more jobs.

Consequently, he announced the abolishing of seven major taxes.Â

They are as follows:

1. Abolishing the 1% special import levy

2. Abolishing of market tolls for Kayayei

3. Abolishing of the 17.5% VAT/NHIL on financial services

4. Abolishing 17.5% VAT/NHIL on domestic airline tickets

5. Abolishing 5% VAT/NHIL on real estate sales

6. Abolish import levies on spare parts

7. Replace 17.5% VAT/NHIL with 3% flat rate for traders

Ofori Atta said the tax cuts would make the cost of doing business in Ghana cheaper and trigger job creation in the hundreds of thousands.

The cuts have been praised by New Patriotic Party politicians, who say it is "magical" and "bold".

Their counterparts at the National Democratic Congress have, however, described the tax breaks as a "419" scam.