The management of defunct Groupe Nduom has petitioned the National Democratic Congress (NDC) flagbearer, John Dramani Mahama, to restore GN Bank’s licence if he wins the December 7 elections.

GN Bank's licence was revoked by the Bank of Ghana in August 2019.

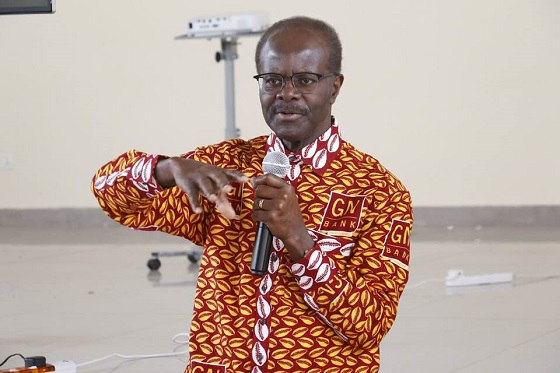

During a meeting with the former president in Accra on Friday, July 19, Dr. Papa Kwesi Nduom, the Global President of Groupe Nduom, voiced concerns about the deteriorating state of the bank’s 300 centres across the country.

“We believe that if this administration doesn’t give us our licence before they leave and start paying the money before they leave, the next one will understand the situation and give the licence back.

We are continuing with the hope and preparing our plans with the hope that, at some point, we will get the licence back and bring the jobs back.

Because it is the jobs that we are also looking for,” Dr. Nduom stated.

He further emphasized that the collapse of a 300-branch financial entity is detrimental to the economic interests of the country.

“Whether it even belongs to us or someone else, it is something that needs to be there,” he added.

John Dramani Mahama criticized the New Patriotic Party (NPP) government’s decision to revoke the licences of some indigenous financial institutions during the 2019 banking sector cleanup, calling it a hasty action.

He also revealed plans to initiate an independent review of the cleanup process if elected.

“I do think that the government was hasty in what it did.

The criteria used didn’t fit; it was not a one-size-fits-all.

It was just like different rules for different folks.

Many of these banks had financed government suppliers and contractors, and the government owed them. But how would they recover that money if you don’t pay the contractors to pay them?

It has affected indigenous capital in the financial and banking sector,” Mahama explained.

He pledged that his administration would work to restore the capital of Indigenous businesses in the financial sector and advocate for an independent review of the processes that led to the banking sector cleanup. “Where we believe these were unjustifiable, we will look at the restoration of the licences of these banks,” Mahama concluded