INTRODUCTION

Businesses are born from the hopes and dreams of their founders. Practical experience, however, has shown that businesses live and die among others by their ability to adapt to changing trends – in the consumer, economic, social, and governmental landscape, etc. A good example is how the outbreak of the Covid-19 pandemic exposed several weaknesses in the supposed ironclad foundations of most businesses while opening new opportunities and avenues rooted in emerging ways of work and life.

Faced with this novel threat to their existence, a lot of businesses were forced to reconsider and re-strategize their approach to providing services, generating revenues, and maximizing consumer satisfaction. Survival became paramount and businesses that could not find answers to questions such as “What can we do to survive in this new reality?”. How can we overcome our competitors? How do we appeal to a different generation of customers/consumers? “etc. collapsed with no chance of re-emergence.

At the core of these and many more questions was the issue of “sustainability”, and the purpose of this article is to attempt the identification of the emerging sustainability issues and propose ways in which businesses can respond to them to aid their continued existence and promote their sustained operations.

WHAT “SUSTAINABILITY” MEANS TO BUSINESSES

An attempt to define “sustainability” should be one which looks at ways/means by which businesses can grow steadily and continue their legal existence for generations. This approach will require an examination of ways businesses can survive turbulent times, respond to new and emerging trends, consolidate stakeholders’ commitments, support, and trust, become good corporate citizens supporting the community, innovate new products and service lines, diversify operations, and build competence leveraging technology and its people, promoting diversity and inclusion at management levels among others. The absence of these concerns in any business management is a clear statement of the unwillingness of the business owners and managers to support the long-term interest of the business and secure its potentially perpetual existence as may be guaranteed by law.

The calls for the adaptation and implementation of sustainable practices and considerations are not calls to ignore the pursuit of profitability. They are calls to balance the pursuit of profits with the interests of other stakeholders – the community, employees, consumers, etc and to align operational and management activities to whatever issue is emerging as important to the world.

And rightly, sustainability has become a hot topic in recent years. The burgeoning prominence of ESG considerations has ensured that more and more companies are paying attention to meeting its standards. A 2021 McKinsey Global survey revealed for instance that businesses with high ratings for ESG performance have enjoyed average operating margins 3.7 times higher than those of lower ESG performers.

The question of sustainability, however, extends beyond ESG standards. It embodies an overall business approach that seeks to create long-term value by taking into consideration how a given business operates in ecological, social, and economic environments. It is founded on the notion that developing relevant strategies in this direction, fosters business longevity.

However, not every business recognizes the value of sustainability as a practice. A study by BCG/MIT in the US has found that whereas 90% of executives find sustainability to be important, only 60% of companies incorporate sustainability in their strategy and merely 25% have sustainability incorporated in their business models. Despite the increasing recognition of sustainability and the benefits it offers, some businesses do not yet know how to draw up a strategic plan that incorporates this approach in their operations.

Businesses simply do not have the answers to the “what, why, and how” of achieving sustainability.

SOME EMERGING SUSTAINABILITY ISSUES AND PROPOSED RESPONSES BY BUSINESSES

The list of emerging sustainability issues and our proposals of responses are bold calls that businesses must incorporate into their strategic plans and religiously drive. But, of course, these are not a one-size fits all solution offered as a remedy to tackle all the existing or anticipated sustainability issues in businesses. However, we contend that any business that focuses on these issues will be better placed to maximize returns in its present operations and secure its future existence.

- Existing sustainable obligations

The surge in emerging sustainable issues does not mean that existing responsibilities and commitments on businesses have been completed and can be disregarded. There is a long list of existing sustainable issues with continuing obligations on businesses that have the potential to prematurely terminate their existence.

These sustainable obligations are formulated as compliance demands which require adherence to sets of rules, regulations, standards, and practices that may be internally or externally required to run a business. And compliance with these obligations enables businesses to run legally and in accordance with the business objectives.

External obligations, which may be termed “regulatory compliance demands” require businesses to abide by general and industry-specific rules, regulations, and standards set by law. For instance, apart from the general requirement of incorporating a company before the commencement of operations and complying with annual and other filings requirements with the Office of the Registrar of Companies (ORC), a company desirous of financial technology (fintech) operations in Ghana is further required to obtain a license from the Bank of Ghana before the rollout of its products or services. A company that defaults on these regulatory demands will be subjected to fines prescribed in law.

Further, the fintech company will be required to comply with the requirements of the law relating to tax payments, pensions, business operating permits, and data protection, among others. Operationally, additional compliance demands will be imposed in respect of anti-money laundering, protection against fraud, consumer protection, etc.

These regulatory demands differ from industry to industry and impose varied compliance demands depending on the nature of the operational activities of a company. While demanding, compliance with these and other regulatory demands is a necessary precondition for a company’s continuous legal existence and permission to engage in its line of product or service delivery – as non-compliance will terminate the life of the company.

On the other hand, a company may have established some rules, policies, standards, and protocols internal to its operations to guide its unique way of work or delivery of products and services. These policies may cover workplace activities such as production procedures, sexual harassment, discrimination complaints, use of business resources, and conflict of interest among others. A novel development in this regard has been the development of remote working policies and social media policies. Although compliance with these internal obligations is not backed by the threats of sanctions, they have attained mandatory status as they effectively facilitate the continuous operations of companies.

Businesses should not expect a waiver on these existing compliance demands – at best new ones may be imposed. Therefore, despite differences in approach to achieving greater corporate compliance, businesses must either set up a compliance program or appoint a compliance officer as the starting point to building a strong culture. For instance, in the Data Protection Act, the law enjoins a company that makes use of sensitive data to have a Data Protection Supervisor who will be responsible for monitoring compliance with the Act by a Data Controller.

Additionally, a business could employ the use of compliance management software that will have embedded in its framework, a process for managing timelines, tracking, monitoring, and providing updates to the company. Alternatively, businesses can seek the assistance of third-party experts in compliance such as lawyers, auditors, or employ the services of the more innovative compliance consulting companies to carry out their directives and ensure that all standards are met.

- Prudent financial management practices

Finances are the “lifelines” of any business and its continuous operation. The survival and growth of a company are directly linked to its financial performance and management practices. Failure to adhere to prudent financial management practices has dire consequences for the sustained operations of any business.

In Ghana, most businesses are run without any distinction between the finances of the owners and that of the businesses. More worrying is where no bookkeeping practices are adopted, and no proper books of accounts are prepared. These practices do not enhance the operational efficiency of businesses. For this reason, small and medium-scale enterprises must begin to implement effective financial practices that will ensure accurate and timely financial reporting and true representations of the financial positions of their businesses.

The first step is always to disentangle the finances of the company from that of the founder. A growing business needs to insulate its finances from its owners and explore other means of funding its operations - through equity financing or debt financing.

Also, a business ought to implement internal control measures such as transaction authorization limits, employment of an internal auditor, development of financial policies, and establishment of clear financial procedures for spending among others.

A sound financial management system that is transparent and adheres to recognized accounting principles will decrease the risks associated with financial malpractices and prevent the business from losing money required for its reinvestment activities.

- Succession Planning

Talents (humans) are critical resources that influence business performance and growth. It is not enough for businesses to recruit and retain skilled professionals. Equally important is the ability to groom through deliberate initiative the next leader of the business.

But, quite often, most businesses or enterprises are managed entirely by the individual founder or owner without any development program for the next leader. The founder forms the nucleus of the operations of the company providing funding, making all decision-making, and generally directing the affairs of the company alone.

Such businesses risk collapse upon the death or even temporary unavailability of the founder. Succession planning is imperative, and it extends beyond finding replacements for crucial positions. It is a key element of the long-term success planning of a business. It fosters the growth of leaders in the company and promotes organizational security.

Succession planning also encompasses an exit strategy for leaders in a smooth manner so as not to disrupt operations. Exiting leaders who are aware of their replacements or successors can provide mentorship and share knowledge/operational competence gained from years of experience. This will allow them to leave a legacy and a lasting mark on the business.

Therefore, every sustainability plan must prioritize succession strategies as it has the potential to ensure continuous operations with fewer disruptions when leadership changes.

- Environmental, Social and Governance (ESG) considerations

With the advent of ESG considerations and the adaptation of its compliance frameworks, far-reaching sustainable practices affecting diverse and emerging issues in the environment, social, and governance practices of companies have taken the centre stage.

This is shifting the focus from the primary concern of the business community away from the quest to make profits to the considerations of how businesses are embedding sustainable business practices in their operations with developed measurable metrics being used to measure a company’s response. It is becoming a standard benchmark for investment appraisals and according to a 2021 EY Global Institutional Investor Survey, 75% of institutional investors said that they were more likely to divest from companies with poor sustainability performance while 90% said that they would now pay more attention to a company’s sustainability performance when making investment decisions.

One component of the ESG wave is the concern about a company’s footprints on the environment. For instance, a company that utilizes coal as fuel in its production processes will be hard-pressed to survive in these changing times. More and more, investors are becoming interested in the innovative practices that companies are implementing in their value chain to reduce their carbon footprint and increase productivity in the same instance. Alternative means of fuel such as solar, wind, or other means are being encouraged as power sources because of their lesser impacts on the environment.

Also, the social considerations of the ESG framework are enabling greater emphasis on a company’s response to community issues of local participation, etc, employee welfare, job security, job satisfaction, etc. It is allowing businesses to develop and implement diversity and inclusive strategies that promote issues affecting particularly women in workplaces such as equal and payment of fair compensation, promotions, maternity and family benefits, career development assistance, and opportunities among others.

On the governance front, companies are aggressively pursuing good corporate governance benchmarks and adopting anti-corruption and anti-bribery programs among other ethical business management practices. This is compelling regulators in some instances to respond by issuing Corporate Governance Guidelines to ensure strict adherence to best practices. These guidelines provide the minimum standards for the corporate governance structures and internal control systems that the related companies must comply with. And includes issues of board composition, mandatory board committees and their composition, their mandate and responsibilities, and audit and risk control functions among others.

A good governance structure would promote transparency, accountability, and efficiency and ensures that a robust risk management system is put in place necessary for fostering long-term investment, stability, and business integrity.

The sweeping and embracing nature of ESG makes it an appropriate framework whose compliance will improve business competitiveness across many benchmarks and help attract the needed investments. In the long run, ESG will help build a business operation that is sustainable and adaptative to the demands of the future. Hence, every business must embrace ESG and be intentional about its demands and compliance should such a business envisages staying operational going forward.

CONCLUSION

Businesses must be plugged in and remain sensitive to the shifting tides in the industry in which they operate. They must learn to cope with and adapt to periods of booms and busts to thrive. It is clear, the practice of sustainability has enormous benefits for businesses and having recognized these, businesses in Ghana must initiate programs that deliberately incorporate sustainability demands discussed in this article into their operations. They stand to gain the advantage of staying in business for the long haul from these initiatives.

ABOUT THE AUTHORS

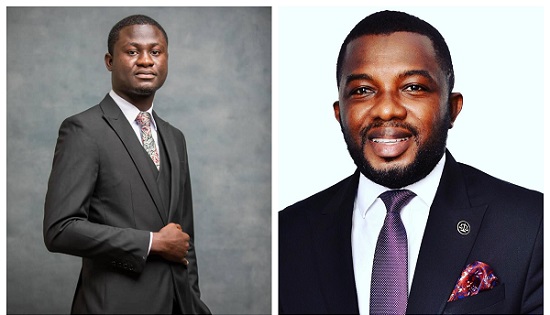

RICHARD NUNEKPEKU is the Managing Partner of SUSTINERI ATTORNEYS PRUC (www.sustineriattorneys.com) a client-centric law firm specializing in transactions, corporate legal services, dispute resolutions, and tax. He also heads the firm’s Start-ups, Fintech, and Innovations Practice division. He welcomes views on this article at richard@sustineriattorneys.com

ANDREWS KWEKU BENIN ANING is an Associate at SUSTINERI ATTORNEYS PRUC with an interest in Commercial Transactions, Intellectual Property, Energy & Mining, Sustainability, and Dispute Resolution. He welcomes views on this article at andrews@sustineriattorneys.com