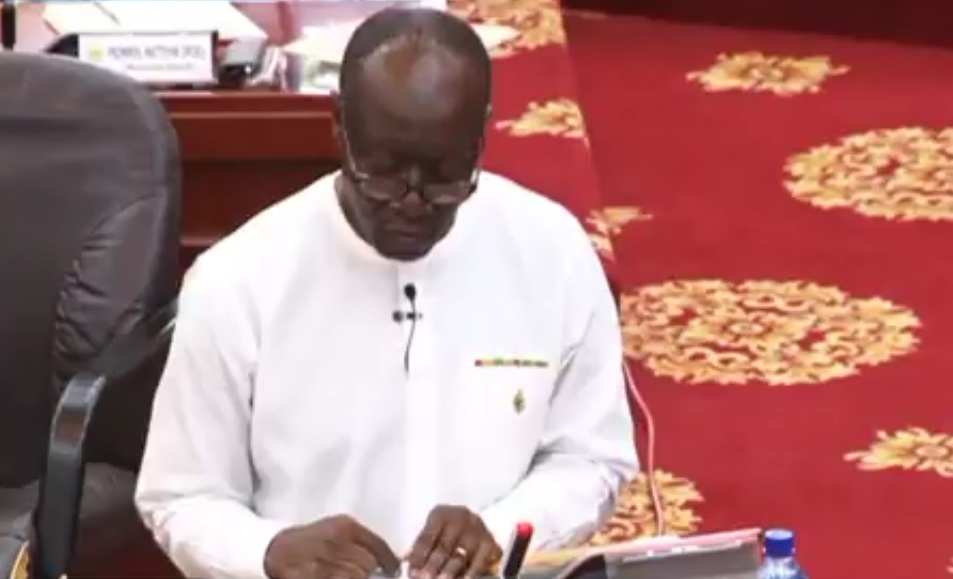

After weeks of fierce exchange of ideas across the media, and an obviously extensive private and public sector consultation, Ghana’s Minister for Finance, Ken Ofori Atta on Thursday, March 2 presented, to the nation’s parliament and people at large, the 2017 budget statement and the administration’s economic policy.

In what is now traditional of the President Nana Akufo-Addo-led government style of presentation, the Finance Minister began by highlighting the progress as well as the flaws of the previous 2016 fiscal year. He noted that the country had missed all the targets stipulated by the IMF’s Extended Credit Facility programme with national debt stock as at December 2016, standing at 73.3 percent of GDP up from 71.63 percent a year earlier.

However, he soon enough went into the real business of the day with the announcement of massive tax cuts across various industries in the private sector: lifting off import duties on spare parts, abolishing of the 17.5% tax on domestic flights (a measure which is certain to significantly reduce air fares and attract more patronage to the service), construction of the eastern railway (between Accra and Kumasi), the allocation of US$1million for each district to address rural poverty and complement the implementation of the one-district-one-factory programme which he said will commence later this month and a commitment to partner with the private sector in addressing the housing deficit issue among others.

He further disclosed the government’s projected end-of-year inflation to be 11.2 percent and overall fiscal deficit at 6.5 percent of GDP adding that the  “estimated expenditure for the year represents a 21 percent increase over the provisional outturn for 2016. Of this amount, GH¢3.7 billion, equivalent to 1.8 percent of GDP and 6.6 percent of total expenditure will be used for the clearance of arrears and outstanding commitmentsâ€.

In what rightly reflected the thoughts of many among the Ghanaian public as to where the country would access funds for its ambitious developmental projects after such tax cuts, Mr. Ken said:

“We believe strongly that, our medium-term policies, anchored on fiscal discipline, a broadened tax base, elimination of wasteful expenditures, prudent debt management strategies, complementary monetary policy, and sustainable external balance, will ensure even better macroeconomic outcomes in the medium-termâ€.

In conclusion, although the presentation was a clearly a bold statement on the direction of the new government and has earned praises from various quarters of the nation (especially the business community), there is need for one to exercise caution in his or her expectations as to what will be achieved in reality within the period. After all, we should all remember that budgets are merely projections and so often constrained by day-to-day realities.